Let’s talk about something crucial for your business: the connection between your sales cycle and Average Contract Value (ACV). It might sound a bit technical, but it’s something that can make a big difference in how you approach selling your product or service. So, let's break it down in a way that’s easy to digest.

What Is ACV, and Why Does It Matter?

First, let’s look at your Average Contract Value (ACV). This is just a fancy term for the average amount of money a customer is paying you over a certain period. Knowing your ACV is key because it influences how long it takes to close a deal, also known as the sales cycle.

The Sales Cycle: How ACV Affects It

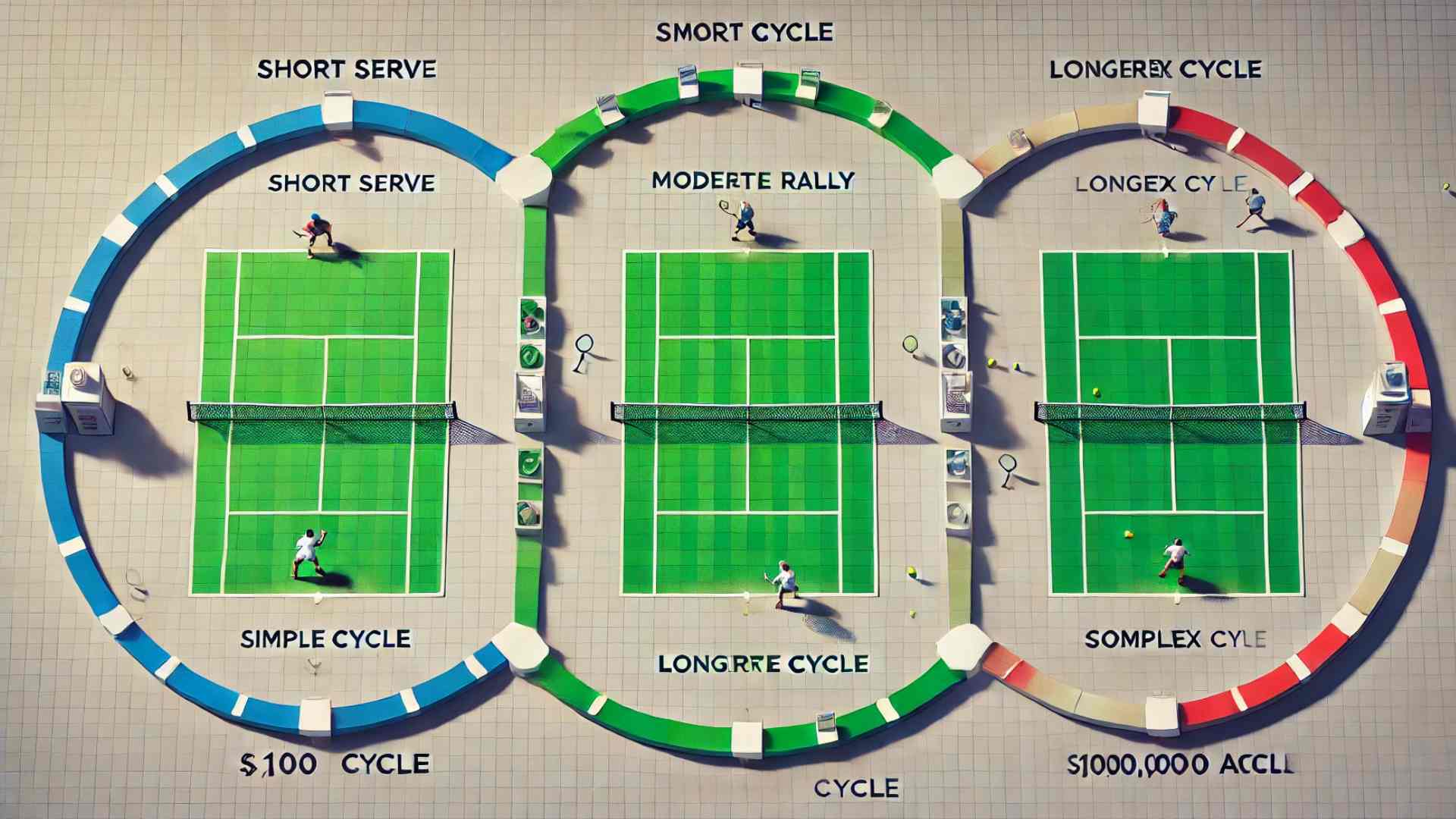

Here's a quick way to think about it:

1. If your ACV is $100:

Your sales cycle is likely pretty short—probably just a few days. When you’re selling something for $100, customers don’t need to spend a lot of time thinking it over. It’s a quick decision, often made on the spot.

2. If your ACV is $1,000:

Now, your sales cycle might stretch out to a few weeks. With $1,000 on the line, customers will take a little more time. They might want to do some research, check out the competition, or get approval from someone else.

3. If your ACV is $10,000:

At this level, you’re looking at a sales cycle of a few months. A $10,000 investment is significant, so your customers are going to be more careful. They’ll likely want to have a few meetings, see a demo, and involve several people in the decision.

4. If your ACV is $100,000:

When you’re dealing with $100,000 contracts, don’t be surprised if your sales cycle stretches into quarters—several months, if not longer. High-value deals like this involve a lot of people, a lot of discussions, and sometimes even a pilot project before they make a commitment.

Why Should You Care?

Understanding this connection between ACV and the sales cycle helps you in a few key ways:

-

Plan Your Resources: If you know that higher-value deals take longer, you can plan your resources and time accordingly. You’ll need more effort and a more personal touch for those big contracts.

-

Predict Revenue: By knowing how long it typically takes to close a deal based on its value, you can better predict when money will come in, helping you manage your cash flow and set realistic goals.

-

Tailor Your Approach: Your sales approach should match the deal size. For smaller deals, focus on speed and efficiency. For larger deals, invest time in building relationships and trust.

How to Use This Knowledge

Here’s how you can put this into action:

-

For Low ACV ($100): Focus on quick, straightforward sales. Automate what you can and aim for volume.

-

For Mid-Range ACV ($1,000): Build relationships and use demos or trials to show value. It’s about giving the customer just enough to make them comfortable.

-

For High ACV ($10,000+): Be ready to invest time. You need to build trust, engage multiple decision-makers, and navigate more complex buying processes.

In short, the more you understand the link between ACV and sales cycle, the better you can plan, predict, and succeed. It’s about working smarter, not harder, by aligning your sales process with the value of the deal you’re chasing.

Startup Hub