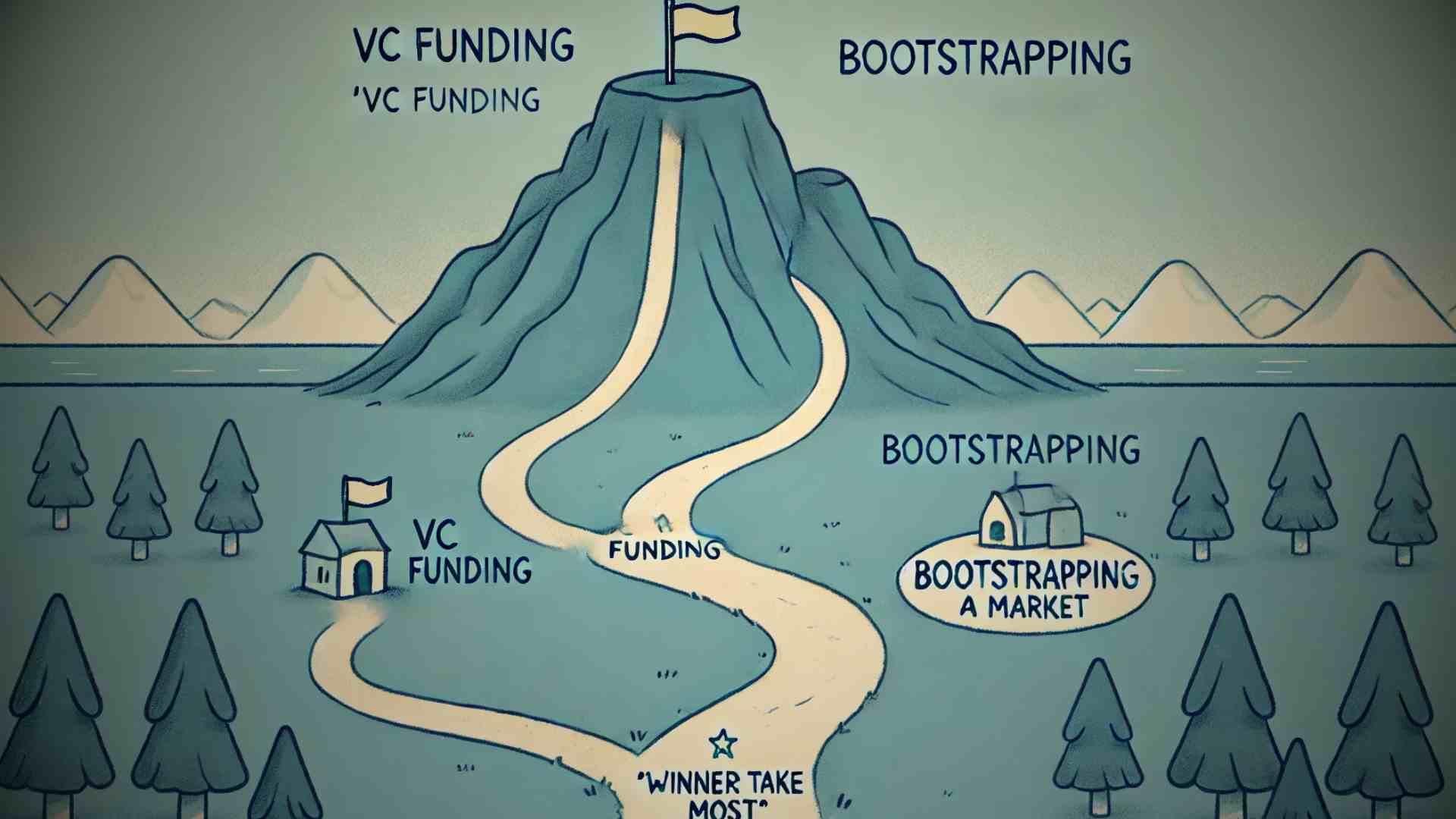

Should You Take VC Money? It Depends on Your Market

When you're building a startup, one of the biggest decisions you’ll face is whether or not to take venture capital (VC) funding. The answer isn’t simple, and it largely depends on the type of market you’re operating in. For some companies, VC money is essential; for others, it might be more trouble than it's worth.

Understanding “Winner Take Most” Markets

A “winner take most” market is one where the top player (or a few top players) eventually dominate. Think of industries like social media platforms, search engines, or large-scale workflow solutions. In these markets, gaining market share early can be the difference between being a major player or getting left in the dust.

Here’s why VC money makes sense in these scenarios:

-

Aggressive Growth Requires Capital: In a “winner take most” market, speed matters. The goal is to capture as much market share as quickly as possible. To do that, you might intentionally drive up your Customer Acquisition Cost (CAC). This might seem counterintuitive, but if you can dominate the market early, those costs will eventually start to decrease as your brand recognition grows and economies of scale kick in.

-

You Need a Big Balance Sheet: Running up your CAC to gain market share isn’t for the faint of heart. You need a large balance sheet to absorb those costs until you reach that tipping point where your CAC starts to decline. This is where VC funding comes in. With a strong cash reserve from investors, you can afford to play the long game.

-

Playing to Win: In these markets, there’s a significant advantage to being the first to scale. The faster you can grow, the more likely you are to become the dominant player. This often requires heavy investment in marketing, sales, and product development—all areas where VC money can provide a crucial boost.

When Bootstrapping Makes More Sense

On the flip side, if you’re in a market that isn’t “winner take most,” the dynamics change. These markets are typically more fragmented, with no single player likely to dominate. Think of niche SaaS products or industry-specific tools that serve a specialized audience.

In these markets, bootstrapping might be the better path:

-

Fragmented Markets Don’t Reward Aggression: In a fragmented market, pushing up your CAC to try and grab more market share doesn’t make as much sense. The market is more likely to stay fragmented, with multiple players carving out their own niches. The extra capital might not lead to significant gains in market share, making it hard to justify the dilution and loss of control that comes with VC funding.

-

Maintaining Control: When you take VC money, you’re not just getting capital—you’re also giving up some control. Investors will have a say in how your company is run, and they’ll expect aggressive growth. If your market doesn’t support that kind of rapid scaling, you might find yourself in a tough spot, trying to meet growth expectations that just aren’t realistic.

-

Focusing on Sustainable Growth: Bootstrapping allows you to grow at your own pace. You can focus on building a sustainable business, rather than chasing growth for growth’s sake. In a fragmented market, slow and steady often wins the race.

The Challenge of Knowing the Difference

The hardest part is understanding which type of market you’re in. Here are a few tips to help you figure it out:

-

Look at Your Competitors: If there are one or two companies in your space that are clearly outpacing the rest, you might be in a “winner take most” market. On the other hand, if there are several companies with similar market share, the market is likely more fragmented.

-

Understand Your Customers: In a “winner take most” market, customers often gravitate towards the biggest players because of network effects or brand recognition. In fragmented markets, customers might have more specific needs that aren’t fully met by the biggest players, allowing smaller companies to thrive.

-

Evaluate Your Growth Potential: Ask yourself if you can realistically scale quickly enough to capture a significant share of the market. If the answer is yes, VC money might be the right move. If not, bootstrapping could be a safer, more sustainable option.

The Right Path Depends on Your Market

Deciding whether to take VC money is one of the most crucial decisions you’ll make as a founder. It’s not just about the money; it’s about understanding the nature of your market and choosing the right strategy for growth.

If you’re in a “winner take most” market, VC funding could give you the edge you need to dominate. But if you’re in a more fragmented market, the extra capital might not be worth the trade-offs. The key is to know your market, understand your business, and choose the path that aligns with your long-term goals.