The B2B SaaS sales cycle feels like navigating a maze blindfolded. You're managing endless follow-ups, navigating corporate bureaucracy, waiting for approvals from people you've never met, and wondering why a simple software purchase requires six signatures.

The complexity stems from a fundamental reality: you're never selling to one person. Every deal involves multiple stakeholders with different priorities, concerns, and influence levels. Understanding who these players are and what they care about transforms sales from guessing game to strategic process.

This guide breaks down the four critical roles in every B2B SaaS sales cycle and how to work with each one effectively.

Why Understanding Sales Roles Matters

Most failed deals don't fail because of product problems or pricing issues. They fail because sellers don't understand the internal dynamics of their prospect's organization.

You pitch features to someone who cares only about cost. You send ROI calculations to someone who can't approve budgets. You wait for a decision from someone who doesn't actually make decisions. Meanwhile, the real decision-maker never hears your pitch at all.

Identifying these players early changes everything. You know who needs what information, who can actually close the deal, and who might derail it. You stop wasting time on the wrong conversations and start building relationships with people who matter.

Impact of understanding sales roles:

- Shorter sales cycles by engaging right stakeholders early

- Higher win rates from addressing each player's concerns directly

- Fewer stalled deals from missing key approval steps

- Better forecasting by understanding true decision authority

- Stronger internal champions by supporting right advocates

Related: How to Build a SaaS Sales Process

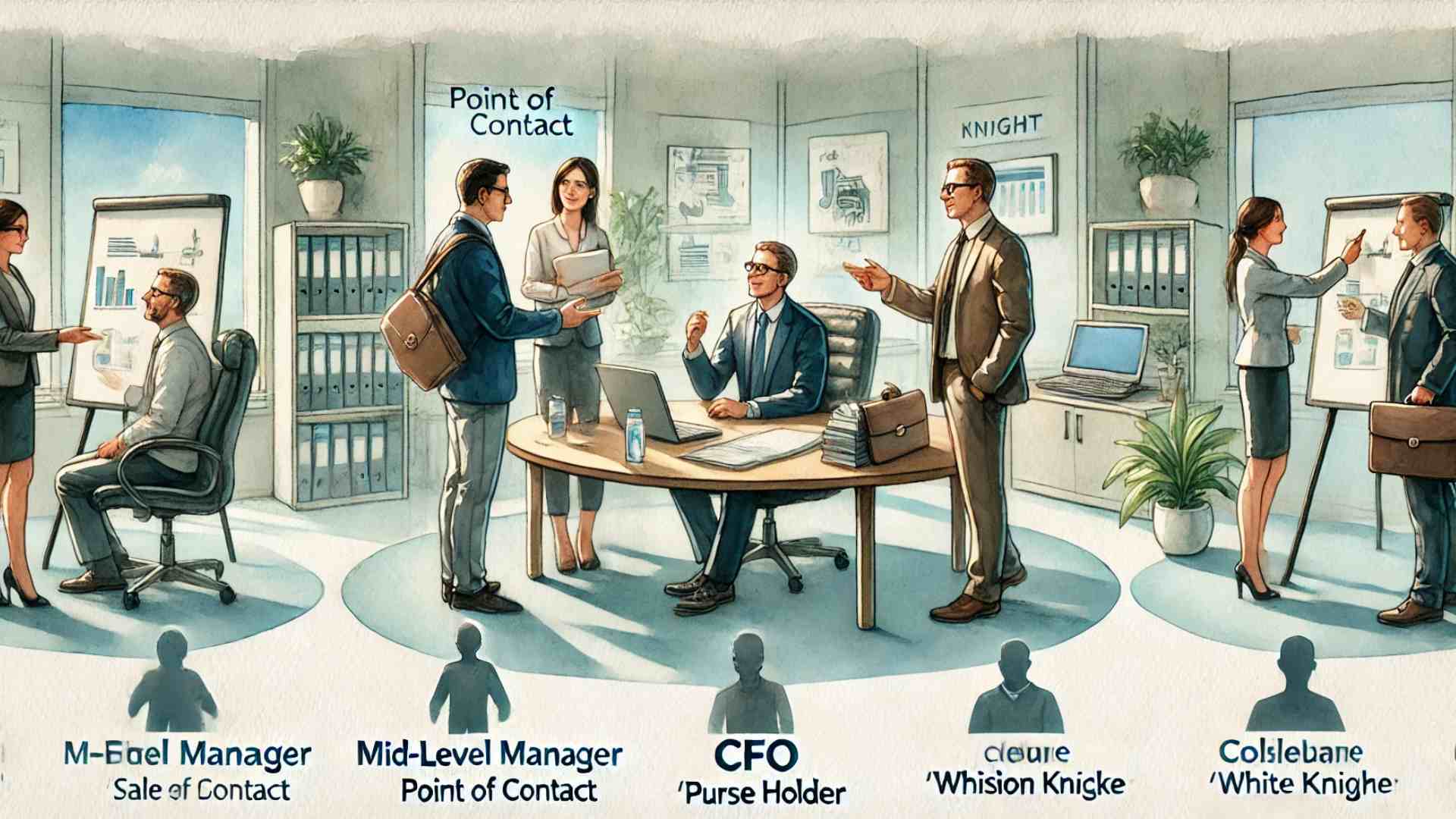

The Four Key Players in B2B SaaS Sales

Every deal involves some combination of these four roles. Sometimes one person plays multiple roles. Sometimes each role involves multiple people. But these archetypes exist in virtually every B2B sales cycle.

Point of Contact (POC): Your Access Point

The POC is typically your first real contact inside the organization. They're usually a manager or individual contributor tasked with researching solutions, organizing demos, and being the primary communication link between you and their company.

Common POC roles include IT managers, operations managers, product managers, or team leads who feel the pain your product solves most directly.

What POCs Care About

POCs care about solving their immediate problem. They need a solution that works, integrates with existing tools, and doesn't create more work for them. They're often technical enough to evaluate your product's capabilities but lack authority to approve significant spending.

Their job is gathering information and making recommendations. They need ammunition to convince others internally that your solution is worth pursuing.

POC priorities:

- Does this actually solve our problem?

- Will it integrate with our existing tech stack?

- How difficult is implementation and onboarding?

- What support and training is available?

- Can I trust this vendor to deliver?

How to Work with POCs

Treat your POC as an internal sales representative for your product. Your job is arming them with everything they need to advocate for your solution inside their organization.

Provide clear documentation, case studies from similar companies, ROI calculations they can present to finance, competitive comparisons, implementation timelines, and answers to objections they'll face internally.

Make them look good. When they succeed in bringing your solution into their organization, they get credit for solving a problem. Help them achieve that outcome.

Supporting your POC:

- Share presentation materials they can use internally

- Provide specific answers to technical integration questions

- Create ROI models with their company's numbers

- Offer references from similar companies or use cases

- Be responsive to their timeline and internal deadlines

- Understand their internal approval process

Common mistake: Treating POCs as gatekeepers to get past rather than allies to support. They're your champion, not your obstacle.

The Purse Holder: Budget Authority

The Purse Holder controls spending authority for the budget your purchase would come from. This is typically someone in finance like the CFO, a VP-level executive overseeing departmental budgets, or a procurement team responsible for vendor contracts.

They don't usually care about feature details or technical specifications. They care about cost, ROI, budget impact, contract terms, and whether this purchase aligns with broader financial priorities.

The $5,000 Threshold

Many organizations have approval thresholds around $5,000 annually. Below this amount, individual managers or department heads can often approve purchases without escalation. Above it, you need budget holder approval.

This threshold varies by company size and industry, but the principle remains: smaller purchases move faster through fewer approval layers.

Understanding your deal size relative to these thresholds helps you forecast timeline and identify who needs to approve.

Purse Holder concerns:

- What's the total cost (including hidden fees, implementation, training)?

- What's the ROI and payback period?

- How does this compare to alternatives or current solutions?

- What are the contract terms and commitment length?

- Can we negotiate pricing or payment terms?

- Does this fit our current budget or require reallocation?

How to Work with Purse Holders

Lead with financial impact. Don't bury the ROI in slide 47 of your deck. Put cost savings, efficiency gains, and revenue impact front and center.

Prepare specific financial justification using their numbers when possible. Generic ROI claims don't work. Calculations showing "based on your team size of 50 people spending 2 hours weekly on this task, our solution saves $X annually" are compelling.

Financial positioning strategies:

- Create ROI calculators with their specific inputs

- Show payback period (ideally under 12 months)

- Compare total cost of ownership vs current solution

- Highlight cost avoidance (problems prevented, not just efficiencies gained)

- Provide flexible payment options (annual vs monthly)

- Include implementation costs transparently

Example: You're selling HR software that automates payroll and benefits administration. For the Purse Holder, emphasize how automating these processes reduces manual processing hours by 50%, eliminates costly payroll errors averaging $3,000 monthly, and requires no additional headcount as the team grows.

Related: SaaS Startup Financial Modeling

The Decision Maker: Final Authority

The Decision Maker has ultimate authority to approve or reject the purchase. This might be the CEO, CTO, department VP, or a committee making collective decisions.

They're weighing strategic fit, not just tactical benefits. Does this align with company direction? Does it support our goals for the next 2-3 years? What are the risks of adopting this vs staying with current approach?

The Challenge of Indirect Access

You often never speak directly with the Decision Maker. They rely on your POC's recommendation, the Purse Holder's financial analysis, and their own strategic judgment.

This creates the challenge of influencing decisions without direct access. Your materials, messaging, and the case you build with other stakeholders must speak for you when you're not in the room.

Decision Maker priorities:

- Strategic alignment with company goals

- Risk assessment (what could go wrong?)

- Long-term viability (will this scale with us?)

- Vendor stability (will you be around in 3 years?)

- Competitive positioning (does this give us an advantage?)

- Organizational change required (disruption to implement)

How to Work with Decision Makers

Understand the company's high-level strategic objectives. Are they focused on growth, efficiency, innovation, market expansion, or something else? Connect your solution directly to these goals.

Even when not speaking to Decision Makers directly, tailor your materials for their consumption. Create executive summaries, strategic overviews, and high-level business cases that POCs can forward upward.

Decision Maker positioning:

- Align solution with publicly stated company goals

- Address strategic questions, not just tactical features

- Show how solution supports their 2-3 year roadmap

- Demonstrate vendor stability and staying power

- Provide executive references from similar companies

- Quantify strategic impact, not just operational efficiency

Example: You're selling a CRM system to a growing SaaS startup. The Decision Maker cares whether your solution scales as they grow from 50 to 500 customers. Focus on enterprise-grade features available now, upgrade paths as they expand, integration ecosystems that grow with them, and how your system eliminates the painful CRM migration they'd otherwise face in 18 months.

Related: Close SaaS Sales Faster: Startup Edition

The White Knight: Internal Champion

The White Knight actively advocates for your solution inside their organization. They might be your POC, a senior executive who believes in your approach, or someone with previous experience using your product successfully.

White Knights are personally invested in getting your deal closed. They see the value, believe in the solution, and use their internal influence to overcome resistance and move things forward.

What Makes a White Knight

White Knights typically have personal motivation beyond just solving the problem. Maybe they used your product successfully at a previous company. Maybe solving this problem directly impacts their performance goals. Maybe they're frustrated with the current solution and passionately believe there's a better way.

Whatever the reason, they care enough to invest political capital in advocating for you.

White Knight characteristics:

- Actively promotes your solution in internal meetings

- Provides insider information about approval process

- Identifies and helps navigate political obstacles

- Coaches you on how to position for specific stakeholders

- Uses their credibility to influence others

- Maintains urgency and momentum

How to Work with White Knights

Support their advocacy without creating ethical issues. Give them tools, information, and confidence to make the internal case.

Don't abuse the relationship by asking them to circumvent proper processes or put their credibility at risk. The strongest White Knights are the ones whose colleagues trust their judgment. Protect that trust.

Supporting your champion:

- Provide materials they can share internally with confidence

- Respond quickly to their requests and questions

- Help them prepare for internal objections

- Acknowledge and appreciate their efforts

- Make them look good when the deal closes

- Maintain confidentiality about insider information they share

Example: You're selling an employee collaboration tool. Your White Knight is a department manager who used similar tools at their previous company and saw the transformation in team productivity. They're personally frustrated with current processes and believe your tool solves the problem. Leverage their experience and credibility by asking them to share specific examples of how collaboration improved in their previous role.

Common mistake: Taking White Knights for granted. These relationships are gold. Nurture them carefully.

Related: B2B SaaS Cold Calling Guide

How Roles Overlap and Combine

These roles aren't always distinct. The same person can play multiple roles simultaneously, especially in smaller organizations.

Common combinations:

POC + White Knight: Your initial contact becomes your strongest advocate. This is ideal when it happens naturally.

Decision Maker + Purse Holder: In smaller companies, the CEO or founder often controls both strategic decisions and budget. This can accelerate deals but also creates single points of failure.

Committee-Based Decision Making: Some organizations distribute decision authority across committees. You might need approval from IT, Finance, Legal, and Executive teams separately.

Decentralized Budgets: Large enterprises often push spending authority down to department level, creating multiple Purse Holders for different aspects of your solution.

Understanding these combinations helps you navigate unique organizational structures without being surprised by unexpected approval requirements.

Navigating the Players: Practical Strategy

Successfully moving deals forward requires engaging the right people with the right messages at the right times.

Identify Players Early

During discovery calls, explicitly ask about decision-making processes and approval workflows.

Questions to ask:

- Who else will be involved in evaluating this solution?

- What does your typical approval process look like?

- Who controls the budget for this type of purchase?

- Who has final sign-off authority?

- Have you purchased similar software before? How did that process work?

- What approval thresholds exist in your organization?

Don't assume you know the structure. Every organization operates differently.

Tailor Messaging by Role

Each player needs different information presented differently.

POC messaging: Technical capabilities, integration details, implementation process, support availability, user experience

Purse Holder messaging: Total cost, ROI, payback period, contract terms, cost comparison to alternatives

Decision Maker messaging: Strategic alignment, competitive advantage, scalability, vendor stability, risk mitigation

White Knight messaging: Ammunition for internal advocacy, responses to likely objections, success stories and proof points

Create separate materials optimized for each audience rather than one generic deck trying to serve everyone.

Build Multi-Threaded Relationships

Don't rely solely on your POC. Build relationships with multiple stakeholders when possible.

Multi-threading protects you when your primary contact leaves, goes on vacation, or loses interest. It also gives you multiple perspectives on internal dynamics and decision-making processes.

Multi-threading strategies:

- Request introductions to other stakeholders early

- Invite multiple attendees to demos and presentations

- Offer separate sessions for technical and executive audiences

- Connect different stakeholders with appropriate team members on your side

- Build relationships naturally without seeming to go around people

Anticipate and Address Objections

Each role has predictable concerns and objections. Address them proactively rather than waiting for them to stall your deal.

POC objections: "Will this integrate with our existing tools?" "How long does implementation take?" "What if it doesn't work as promised?"

Purse Holder objections: "This seems expensive compared to alternatives." "What if usage is lower than projected?" "Can we start with a pilot instead of full commitment?"

Decision Maker objections: "Is now the right time?" "What if the vendor gets acquired or shuts down?" "How disruptive is this to implement?"

Prepare responses before objections arise. Better yet, structure your positioning to address concerns before they're raised.

Related: Players in the Sales Cycle

Common Mistakes in Managing Sales Roles

Focusing only on the Decision Maker: You can't reach them directly anyway. Build your case through the players you can access.

Ignoring the Purse Holder: Even with executive buy-in, deals die when finance kills them. Address budget concerns early.

Treating POCs as obstacles: They're your allies. Support them and they'll support you.

Assuming org charts show decision authority: Formal reporting structures don't always reflect real influence and decision-making power.

Rushing past discovery: You can't navigate players you haven't identified. Invest time understanding organizational dynamics.

Using identical pitches for different audiences: Each stakeholder needs different information framed differently.

Losing momentum between approval stages: Each handoff between players creates delay risk. Maintain urgency throughout.

Deal Acceleration Through Role Understanding

Understanding sales roles doesn't just help you close deals—it helps you close them faster.

Acceleration strategies:

Parallel processing: Engage multiple stakeholders simultaneously rather than sequentially. Don't wait to address finance concerns until after technical evaluation completes.

Pre-empting approval stages: Provide budget justification during initial POC conversations so they're prepared when the question arises.

Leveraging White Knights: Use champions to navigate internal processes you can't see or influence directly.

Right-sizing engagement: Match your team to theirs. Let executives speak to Decision Makers, technical teams to POCs, finance teams to Purse Holders.

Creating urgency: Align your timeline to their priorities and deadlines, not yours. "We want to close by quarter-end" is weak. "This solves the problem blocking your Q1 launch" creates real urgency.

The B2B SaaS sales cycle is complex because organizations are complex. Multiple stakeholders with different priorities must align before deals close.

Understanding the Point of Contact, Purse Holder, Decision Maker, and White Knight transforms sales from frustrating mystery to navigable process. You know who needs what information, who can move things forward, and who might create obstacles.

Identify these players early. Tailor your approach to each one's priorities. Build relationships across multiple stakeholders. Address objections before they arise.

Sales success in B2B SaaS comes from navigating organizational dynamics as skillfully as you demonstrate product value.

Related reading:

Startup Hub