Accelerators and incubators play a materially different role in Canada than they do in the US. They are not shortcuts to venture capital and they are not interchangeable. In 2026, the strongest Canadian programs function as early signal amplifiers: they reduce execution risk, compress learning cycles, and make young companies legible to later capital providers.

This guide is designed as a practical comparison for founders. It explains how accelerators and incubators differ, what each type is actually good for, how investors interpret them, and how to choose programs by city and stage without defaulting to brand names alone.

Accelerators vs Incubators: The Distinction Still Matters

Accelerators are time-bound, cohort-based programs designed to push companies toward a specific outcome, usually fundraising or commercial readiness. They emphasize speed, pressure, and external accountability. Incubators are longer-term environments focused on company formation, experimentation, and capability building, often before a clear business model exists.

In Canada, accelerators tend to be more selective and outcome-driven, while incubators are more integrated into universities, research institutions, and regional economic development bodies. Founders often misunderstand this and apply too early or too late, which creates misalignment and wasted cycles.

A useful rule of thumb is this: if you already have a defined product direction and early market signal, accelerators help you sharpen and surface it. If you are still forming the company, validating the problem, or navigating technical uncertainty, incubators are usually the better fit.

What Changed in 2025–2026

Three shifts matter for founders evaluating programs in 2026. First, many accelerators reduced cohort sizes and increased selectivity, prioritizing companies with clearer traction or technical validation. Second, corporate and government-backed incubators expanded, particularly in AI, climate, life sciences, and advanced manufacturing. Third, investor interpretation tightened. Participation alone is no longer a signal; outcomes during the program are what matter.

As a result, founders should evaluate programs less by logo and more by what actually happens during and after the program. Access to customers, quality of mentorship, and clarity of next-step outcomes matter more than demo day theatrics.

National Accelerators with Broad Reach

Some Canadian accelerators operate nationally and are designed to plug companies into cross-regional networks. These programs typically suit founders with scalable ambitions and a willingness to engage beyond their local ecosystem. They tend to be strongest for companies preparing for Seed or Series A and for teams that benefit from investor exposure across provinces.

Founders should treat these programs as structured pressure tests. If your narrative, metrics, or team dynamics are weak, they will surface quickly. That is a feature, not a bug.

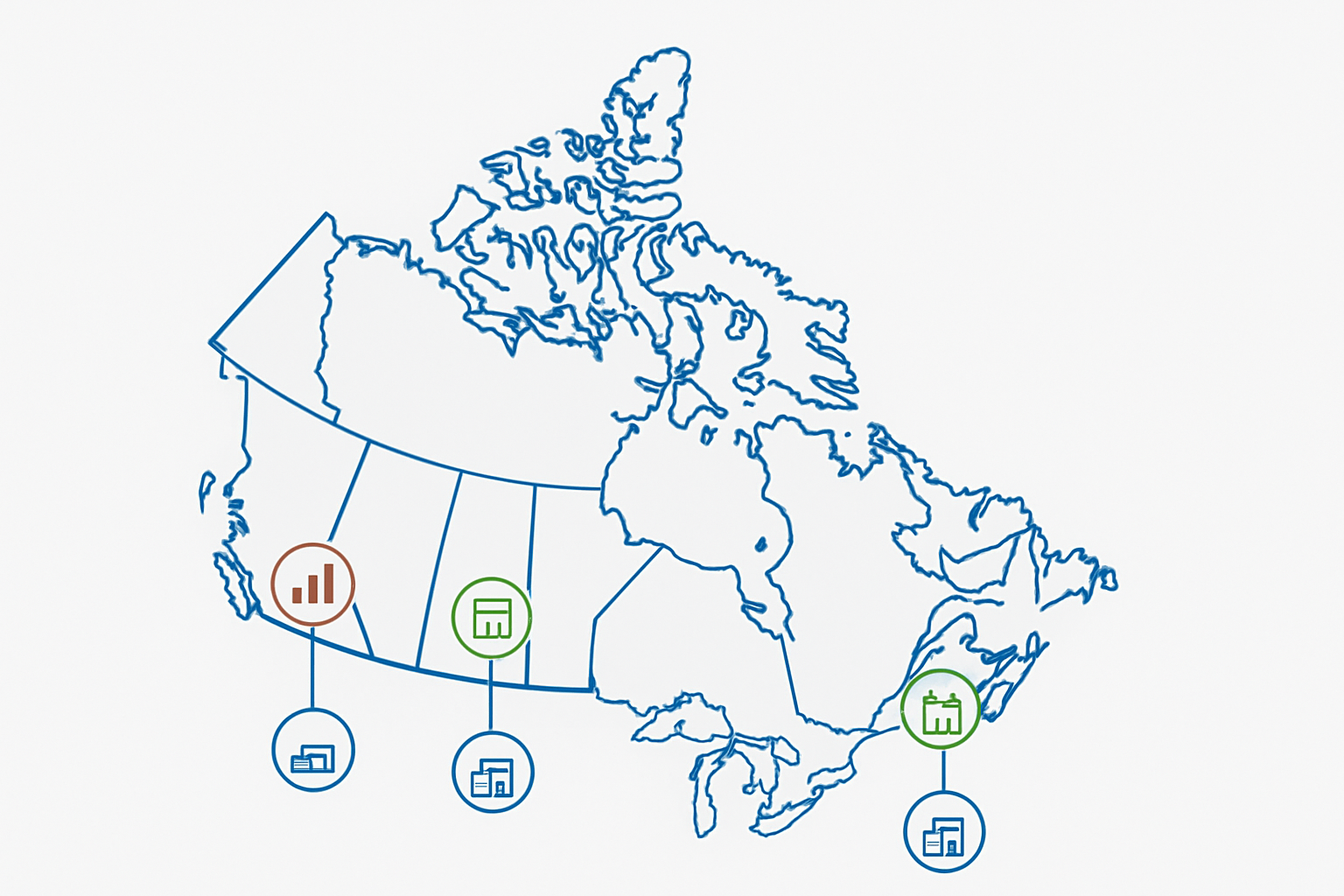

City-by-City Accelerator and Incubator Landscape

Canada’s startup support ecosystem is highly regional. Each major city has distinct program strengths shaped by local industry, talent pools, and funding availability. Founders are often best served by starting locally, then expanding outward once fundamentals are in place.

Toronto and the broader Ontario corridor offer the densest mix of accelerators, incubators, and venture studios, particularly for B2B software, fintech, and enterprise infrastructure. Programs here tend to emphasize go-to-market discipline, compliance awareness, and investor readiness. ShoutEx’s Toronto and Ontario city guides break down these local options in detail.

Waterloo remains tightly coupled to technical incubation, university-linked programs, and deep engineering talent. Incubators here are particularly effective for technically complex products and early experimentation before commercial scale. See the Waterloo-focused ShoutEx guide for specific programs and entry criteria.

Montreal continues to stand out for AI, deep tech, and research-driven startups. Accelerators in Quebec often expect stronger technical depth and benefit founders with close ties to academic or research institutions. ShoutEx’s Montreal city article covers the key provincial and city-backed programs.

Vancouver programs skew toward product-led companies, climate innovation, and globally oriented startups. Accelerators here often emphasize early customer validation and international expansion. Local program comparisons are covered in the Vancouver ShoutEx guide.

Calgary and Edmonton have grown materially in relevance, particularly for energy transition, industrial software, and applied AI. Programs in Alberta are often well-aligned with non-dilutive funding and pilot opportunities. ShoutEx’s Alberta city articles outline the most active accelerators and incubators.

Halifax and Atlantic Canada offer smaller but tightly connected ecosystems. Incubators here are often deeply supportive and well-suited for early-stage founders who benefit from hands-on guidance and regional grants. See the Atlantic Canada ShoutEx guide for local programs.

How Investors Interpret Accelerator Participation

Investors do not fund companies because they joined an accelerator. They fund companies because of what changed during the program. In 2026, investors look for evidence that an accelerator helped clarify product-market fit, sharpen go-to-market execution, or improve founder decision-making.

Accelerators that provide real customer access, disciplined feedback loops, and credible external validation carry more weight than those that focus primarily on pitch polish. Incubators are viewed more neutrally, but they are often respected when they are clearly aligned with technical depth or regulated industries.

Founders should be prepared to articulate not just where they participated, but what they learned, what changed, and what milestones were achieved as a result.

Choosing the Right Program: A Practical Framework

Before applying to any accelerator or incubator, founders should answer three questions. What specific gap does this program help close right now? What outcome should exist at the end of the program that does not exist today? And is the program aligned with the company’s next funding or growth milestone?

If the answers are vague, the program is probably not the right fit yet. The best programs feel demanding, not comfortable.

Final Perspective

Canadian accelerators and incubators are most valuable when they are used deliberately. In 2026, the advantage does not come from collecting program logos, but from choosing environments that force clarity, accelerate learning, and reduce execution risk at the right moment in a company’s lifecycle.

Founders who treat these programs as strategic tools rather than validation badges consistently outperform those who apply by default.

Disclaimer

This content is for general information only and does not constitute legal, financial, or investment advice. Programs, availability, and selection criteria change over time; founders should verify details directly with each accelerator or incubator before applying.

ShoutEx Insights

- Canadian Startup Ecosystem: Ultimate Guide 2026

- DMZ vs Creative Destruction Lab vs Velocity: Accelerator Comparison

- How to Get Accepted into Top Canadian Accelerators: Application Guide

- Best Accelerators by Province: Regional Guide

- Toronto's Startup Ecosystem: Canada's Tech Capital

- Vancouver's Startup Ecosystem: BC's Tech Innovation Leader

- Montreal's Startup Ecosystem: Quebec's Innovation Powerhouse

- How to Raise Seed Funding in Canada

- Canadian Government Grants and Startup Funding

Further Readings:

- Hiring Trends in Canada

- MaRS Discovery District: Toronto Innovation Hub

- DMZ at Toronto Metropolitan University: Top-Ranked Accelerator

- Creative Destruction Lab: Science-Based Startup Program

- Velocity: University of Waterloo Incubator

- Communitech: Tech Ecosystem Builder

- District 3: Concordia Innovation Center

- Propel ICT: Atlantic Canada Accelerator

- L-SPARK: SaaS-Focused Accelerator in Ottawa

Last updated by the Team at ShoutEx on January 19, 2026.

Frequently Asked Questions

What is the core difference between accelerators and incubators in Canada?

Accelerators are fixed‑length, cohort‑based programs that push companies toward outcomes like fundraising or commercial readiness under time pressure. Incubators provide longer‑term environments for company formation, experimentation, and capability building, often before a clear model or market exists.

How did Canadian accelerators change in 2025–2026?

Many accelerators reduced cohort sizes and raised their bar, concentrating on teams with clearer traction or technical validation. This made participation a stronger filter but also increased the importance of arriving with a real product direction and early market signal.

When is an accelerator the right choice for a founder?

An accelerator is usually a good fit when you already have a defined product direction, early evidence of market pull, and a near‑term funding or launch milestone. The program should help you sharpen your narrative, stress‑test metrics, and systematically prepare for Seed or Series A.

When does an incubator make more sense?

Incubators are better suited for founders still validating the problem, shaping the company, or working through technical uncertainty. University‑linked and regionally backed incubators in Canada can be ideal for deep tech, research‑driven, or regulated‑industry startups that need time and support before scaling.

How do investors read accelerator participation on a pitch deck in 2026?

Investors care less about the brand name and more about what changed during the program: sharper product‑market fit, better go‑to‑market execution, key customer wins, or upgraded founder judgment. Simply listing logos without clear outcomes does little to improve credibility.

How should founders factor geography into their program choice?

Founders should start by mapping local strengths: Toronto/Ontario for B2B software and fintech, Waterloo for technical incubation, Montreal for AI and deep tech, Vancouver for product‑led and global companies, Alberta for energy transition and industrial software, and Atlantic Canada for hands‑on early support. From there, they can layer in national accelerators that match their next funding milestone.

What questions should founders answer before applying to any accelerator or incubator?

Before applying, clarify what specific gap the program helps close, what concrete outcome should exist at the end that does not exist today, and how that outcome links to your next funding or growth milestone. If you cannot answer those questions crisply, it is usually too early—or the program is not the right fit.